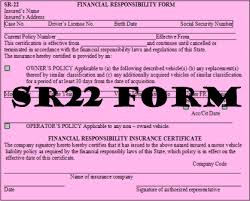

Get a Texas SR22 Insurance Filing Today

Your insurance carrier will either file your Texas SR22 insurance online or through the mail. By mail it could take you up to 21 days to get your SR22 processed in Texas, depending on which insurance company you use. However, you don’t have to wait that long, thanks to DPS Express, which allows your insurance company to file your SR22 in Texas immediately.

Our local Progressive agent offers an electronic SR22 service for you. When filed electronically, your SR22 typically hits the state databases within 12 to 24 hours. Austin Insurance Group can provide an instant Texas SR22 Insurance quote and filing.

The Texas DPS:Your Driving record For speeding tickets or anything else on your driving record, you can order your driving record through DPS. This information can give you a good idea in advance of whether or not you will be paying a lot of surcharges on Texas SR22 insurance. SR22 in Texas Instead of hiring an attorney to fill out the paperwork for an SR22, your insuance company can handle the SR22 filing for you in Texas, or out-state. Contact Austin Insurance Group’s local Austin, Pflugerville or Cedar Park office. License reinstatement Before you get your SR22 in Texas, it is necessary for you to reinstate your license. The method of doing this isn’t exactly clear, so if you need some help navigating the paperwork, you can sign up for DPS. Accident reports Whenever you’re filing a car insurance claim, it can be handy to have the accident report as documentation to prove your side of the story. You can order an official copy from the DPS. SR22 Insurance Quote Contact our office for more information on Progressive SR22 insurance. Austin – Cedar Park – Pflugerville How Long Does It Take to Get Texas SR22 Insurance? |