Get Car Insurance Facts

Purchasing auto insurance can be confusing. Knowing some car insurance facts can help you make the right choice.

Below are six car insurance facts to help you plan and possibly save you money:

1. Car Rental Insurance

We’ve all experienced the insurance pitch at the rental car counter. The agents encourage you to purchase car rental insurance, referred to as a collision damage waiver (CDW). Rental car agents often receive incentives to sell it. The good news is that you usually don’t need to purchase it, assuming you have full coverage on your own car, which commonly includes comp and collision.

We’ve all experienced the insurance pitch at the rental car counter. The agents encourage you to purchase car rental insurance, referred to as a collision damage waiver (CDW). Rental car agents often receive incentives to sell it. The good news is that you usually don’t need to purchase it, assuming you have full coverage on your own car, which commonly includes comp and collision.

If you are driving a vehicle with liability only, have a “limited” policy or no insurance coverage at all, CDW will be required. Many credit card companies offer rental car insurance protection as long as the entire rental car transaction is charged to that specific card. So, make sure to check with your credit card company or personal auto insurance company before denying CDW coverage

2. Lending Your Car to A Friend Could be Costly

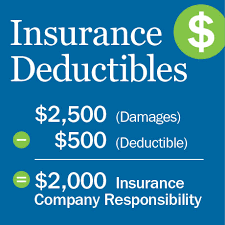

If you lend your car to a friend and they have an accident, it’s your responsibility. Even if they have their own insurance, it usually only covers damage to the other vehicle, not yours. So, you will have to file a claim with your insurance company, not your friend’s AND you’re also responsible for your deductible. This type of accident could possibly raise your rates, even if you were not in the car. So think twice before handing over your keys.

If you lend your car to a friend and they have an accident, it’s your responsibility. Even if they have their own insurance, it usually only covers damage to the other vehicle, not yours. So, you will have to file a claim with your insurance company, not your friend’s AND you’re also responsible for your deductible. This type of accident could possibly raise your rates, even if you were not in the car. So think twice before handing over your keys.

3. Your Credit Score

Your credit score is reviewed by your auto insurance company. Statistically speaking, you’re more likely to file claims based on a shaky credit history. Ff you are responsible with your credit and make payments on time, you’re less likely to make regular claims. So your credit score plays a major role in determining rates. Usually credit score information may result in higher premiums, even if you have a perfect driving record and no accidents.

Your credit score is reviewed by your auto insurance company. Statistically speaking, you’re more likely to file claims based on a shaky credit history. Ff you are responsible with your credit and make payments on time, you’re less likely to make regular claims. So your credit score plays a major role in determining rates. Usually credit score information may result in higher premiums, even if you have a perfect driving record and no accidents.

4. Will You Get Your Cars True Value?

If you get into an accident and your car is “totaled,” it’s your insurance company’s responsibility to provide you with enough money to purchase an equivalent car. Every car is different, with things like mileage, condition, and repairs play a vital role. You should always keep a documented vehicle history, so you can present repair and maintenance receipts in the event of a dispute. Make sure the amount you and your insurer settle on includes sales tax for the purchase of your replacement automobile. This is sometimes left out by insurers, and replacing your car should not come with additional tax costs. If you have a classic car make sure you have classic car insurance that provides replacement value coverage, otherwise you’re putting your investment at risk.

If you get into an accident and your car is “totaled,” it’s your insurance company’s responsibility to provide you with enough money to purchase an equivalent car. Every car is different, with things like mileage, condition, and repairs play a vital role. You should always keep a documented vehicle history, so you can present repair and maintenance receipts in the event of a dispute. Make sure the amount you and your insurer settle on includes sales tax for the purchase of your replacement automobile. This is sometimes left out by insurers, and replacing your car should not come with additional tax costs. If you have a classic car make sure you have classic car insurance that provides replacement value coverage, otherwise you’re putting your investment at risk.

If you get into an accident and your car is deemed repairable, make sure to ask for diminished value compensation. This will pay you for the loss of market value that your vehicle incurs due to the accident and repairs. Once your car has been in an accident the value goes down, even if completely repaired to like new condition. Most people don’t want to risk purchasing a car that’s been in a major accident, and this substantially hurts your re-sale value. It’s always a good idea to check with the car insurance company to see if they offer diminished value, prior to purchasing a policy.

5. Marital Status

If you are single, divorced, or even widowed, your marital status can affect your auto insurance premium. Many auto insurance companies give discounts for being married because statistics show that unmarried individuals are more prone to accidents.

6. Where You Live

Your zipcode is one of the major considerations your auto insurer looks at when determining your rates.

Living in urban areas can greatly increase the rates you pay for auto insurance. The chance of accident or auto theft are significantly lower in rural areas. Whereas, things like limited parking, traffic, and larger numbers of uninsured motorists are factors for individuals living in the inner city. Some areas may result in auto insurance rates that are more than double their rural counterparts. It’s unfortunate, but expect to pay more if you move to the city. And if you have a choice, compare insurance rates in different zip codes to see how much of a difference it makes.

If your business is required to have a Texas Interstate Truck Filing or State filing form, we can help you. Here is a list of the Texas Interstate Truck Filings required by the Texas Department of Transportation. TxDot.

If your business is required to have a Texas Interstate Truck Filing or State filing form, we can help you. Here is a list of the Texas Interstate Truck Filings required by the Texas Department of Transportation. TxDot.